Buying a home may seem like a daunting and scary thing. It’s funny; the minute you mention you are starting to look for a house, every family member, friend or neighbor’s dog has some horror story. However… it doesn’t have to be that way. One of my biggest priorities is educating buyers on what to expect throughout the process. It is all about expectation and education.

Buying a home may seem like a daunting and scary thing. It’s funny; the minute you mention you are starting to look for a house, every family member, friend or neighbor’s dog has some horror story. However… it doesn’t have to be that way. One of my biggest priorities is educating buyers on what to expect throughout the process. It is all about expectation and education.

Upon my first visit with a client, one of the first things we discuss is what it takes to get a loan. Getting a loan is based on the 4 C’s; 1) Credit 2) Capacity 3) Cash and 4) Collateral. Let’s discuss each one in detail.

1. Credit:

This is what I like to call the “first barrier to entry.” Credit is a statistical prediction of a borrower’s future payment likelihood. If you are paying your bills on time and are not maxed out on your debt, your credit score will be higher. If you have late payments, collections, bankruptcy’s, foreclosures or maxed out on your debt, your credit score will be lower. The higher there credit score, the lower risk you are to a bank which usually results in better loan terms for you. Your credit doesn’t have to be perfect to get a home loan. One point can make a difference in your approvability. If your lender requires a 620 credit score, 619 will not work. However, if there are some blemishes on your credit, there is no need to worry. We will help you work through them, quickly, so you are able to get approved.

2. Capacity: (Debt to Income):

Banks want to know that a borrower has the “capacity” to pay their bills. They look at it from two ways; A) Housing Ratio B) Total Debt Ratio.

Housing Ratio: This ratio is your total house payment (principal & interest, real estate taxes, homeowner’s insurance and any mortgage insurance) divided by your monthly income. A good rule of thumb is you can afford 25-35% of your monthly pay.

Total Debt Ratio: This ratio is all your debt (new house payment, car payments etc.) divided by your monthly income. You want to keep this ratio at 45% or less, however, there some loan programs that allow a higher number.

3. Cash: (How much money you have between bank accounts and retirement accounts): We, as lenders, looks at two items in this section; A) Down payment B) Cash reserves.

Down Payment: Not all loans require a down payment, however, the higher the down payment, the stronger the deal looks.

Cash Reserves: The more money that is in your bank after closing usually means there is a smaller chance of you defaulting on the loan. Also, there are many Grant programs available that can help with your down payment, which would keep your money in your bank!

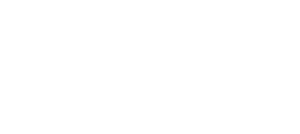

4. Collateral: (This is referring to the property you are buying.) When lenders are looking at the properties you are purchasing, they want to make sure it is worth the purchase price. Appraisers will inspect the property and compare it to similar homes in that area (size, square footage, condition etc.). Also, banks need to have something to secure the loan. Even though banks do not like to foreclosure on anyone, if that situation arises, they want to have something to sell to try to recoup their loan.

4. Collateral: (This is referring to the property you are buying.) When lenders are looking at the properties you are purchasing, they want to make sure it is worth the purchase price. Appraisers will inspect the property and compare it to similar homes in that area (size, square footage, condition etc.). Also, banks need to have something to secure the loan. Even though banks do not like to foreclosure on anyone, if that situation arises, they want to have something to sell to try to recoup their loan.

Once you know what a lender is looking at when you apply for a mortgage, it makes it easier to understand why we ask for certain documentation. At the end of the day, we want you to succeed in homeownership. I love what I do, and I am blessed with the honor of helping my clients achieve that. The more I can educate my clients, the more pleasant the transaction. And finally; if you understand that lenders do not want any more foreclosures, then you will understand why we check and verify the 4 pillars of a loan.